The Relationship between Caproate Governance and Financial Performance - Management Ownership and Financial Performance in Non-Takaful Insurance Companies: Evidence from Egypt

Corporate governance encompasses a framework of regulations, guidelines, and practices governing the interactions between a company's management, board of directors, and stakeholders. Evidence suggests that effective corporate governance positively influences a company's financial performance. This significance is particularly pronounced in the insurance sector due to insurers' substantial assets and liabilities, heavily reliant on trust and reputation. This review aims to examine the interplay between corporate governance and financial performance within non-takaful insurance companies in Egypt. Non-takaful insurance companies refer to conventional insurance companies that operate on traditional principles, distinct from takaful insurance companies that follow Islamic principles.

Extensive research has delved into the correlation between corporate governance and financial performance in insurance firms. Researches underscore that favorable corporate governance practices, including autonomous board members, robust risk management, and transparency, correlate positively with financial outcomes. (Clarke and Dean, 2007) found such practices linked to elevated return on equity and reduced risk levels in the insurance sector.

The composition of a company's board is a crucial facet of corporate governance. (Adams and Mehran, 2005) revealed that the inclusion of independent directors on a board is positively tied to financial performance—associated with enhanced profitability and decreased risk in the insurance realm.

Effective risk management forms another vital dimension of corporate governance in insurance entities. Studies highlight that superior risk management translates into improved financial performance and heightened profitability (Cummins et al., 2006).

Transparency represents a pivotal element of corporate governance within insurance companies. Transparency's positive impact on financial performance is evident, as companies disclosing greater information tend to exhibit enhanced profitability. (Choi et al., 2012) observed that heightened information disclosure corresponds with amplified profitability and reduced risk levels in the insurance industry.

Furthermore, diverse sectors have evidenced a positive relationship between corporate governance and financial performance. (Nguyen and Nguyen, 2020) investigated the connection between corporate governance and firm performance in Vietnam, yielding a substantial affirmative correlation. Similarly, (Ahmed and Hossain, 2021) explored corporate governance's influence on financial performance in the banking sector of Bangladesh. Their research indicated that corporate governance practices, such as board independence, size, CEO duality, ownership structure, and audit quality, significantly impact financial performance. Their study of 30 banks listed on the Dhaka Stock Exchange emphasized the role of robust corporate governance in enhancing investor confidence and driving improved financial outcomes.

this section will provide an in-depth exploration of the fundamental concepts that form the foundation of corporate governance, shaping its practical implementation.

Corporate Governance History

Corporate governance, a pivotal facet of contemporary business practices, entails the rules, regulations, and procedures governing the interplay between a company's management, board of directors, and stakeholders (Clarke, 2004). Its significance lies in its capacity to foster positive financial outcomes, particularly pertinent in the insurance industry where the sensible management of substantial assets and liabilities hinges upon trust and reputation.

Corporate governance's historical course can be traced back to ancient times, with its foundational principles having roots in ancient Babylon's Hammurabi Code around 1772 BC (Clarke, 2004). The Hammurabi Code underscored the values of accountability and transparency in business operations, preserving stipulations for corporate officers' liability, business conduct regulation, and safeguarding shareholder interests.

The emergenceof joint-stock companies in the 17th century marked a significant development in the formulation of corporate governance principles. The Dutch East India Company, established in 1602, set the tone for modern corporations, introducing limited liability for shareholders (Saha, 2017). The Industrial Revolution of the 18th and 19th centuries ushered in the domination of modern corporations, warranting heightened attention to corporate governance. In the United States, the 1887 establishment of the Interstate Commerce Commission marked the government's initial involvement in regulating corporate behavior, addressing concerns such as insider trading, fraud, and conflicts of interest (Gillan & Martin, 2016).

The 20th century witnessed a paradigm shift, spotlighting the pivotal role of boards of directors in supervising corporate strategy and performance. The Cadbury report of 1992, prompted by public trust loss due to corporate scandals, sparked transformative changes in UK corporate governance (Monks and Minow, 2011). The report's recommendations aimed at enhancing director accountability and board effectiveness reverberated globally, influencing governance codes in the US, Australia, and beyond.

The Cadbury report's highest point was its proposition of a code of best practices, furnishing a transparent and accountable operational framework. It underscored the significance of board composition, chairman's role, internal control, and risk management (Cadbury, 1992). The report's initiative extended to mandating audit committees for financial reporting oversight, amplifying financial accuracy, and bolstering investor assurance (Kumar & Singh, 2018).

Subsequently, the Sarbanes-Oxley Act of 2002 emerged in the wake of the Enron scandal to enhance corporate transparency and accountability (Sweeney, 2019). This landmark legislation mandated improved financial reporting accuracy, established the Public Company Accounting Oversight Board, and heightened penalties for financial fraud (Sarbanes-Oxley Act, 2002).

The 2008 Global Financial Crisis intensified the examination of corporate governance as weak governance facilitated risky practices. Regulatory reforms arose globally, such as the Dodd-Frank Act in the US, seeking transparency, risk committees, and diversified boards (Stowell, 2012). The crisis underscored the need for responsible corporate conduct and impelled the evolution of governance frameworks worldwide.

In sum, the evolution of corporate governance reflects enduring accountability and transparency principles, adapting to evolving societal and business needs. This historical journey serves as a backdrop for comprehending the implications of corporate governance definitions for ethical and sustainable corporate operations, as explored further in the subsequent section.

CorporateGovernance Definition

Corporate governance has garnered significant attention from scholars, practitioners, and policymakers in recent years, prompting various definitions that capture its complex and multifaceted nature. Although a universal definition of corporate governance is absent, diverse interpretations have been proposed by researchers, shedding light on distinct dimensions of this complex concept. This section examines key definitions advanced by scholars, underscoring their implications for enhancing corporate conduct and performance.

(Cadbury, 1992) introduced one of the earliest definitions, characterizing corporate governance as "the system by which companies are directed and controlled." This formulation underscored the significance of effective leadership, accountability, and transparency in guiding corporate decisions and outcomes (Cadbury,1992). The Organization for Economic Cooperation and Development (OECD) contributed a similar definition in 1999, defining corporate governance as "the system by which business corporations are directed and controlled" (OECD, 1999). This perspective emphasized the role of boards of directors in supervising corporate management and emphasized the need for robust mechanisms of accountability and transparency to ensure alignment with stakeholders' interests.

More contemporary definitions have sought to encompass a broader spectrum of actors and factors. (Shleifer and Vishny, 1997) defined corporate governance as "the set of mechanisms through which outside investors protect their interests against insiders' attempts to expropriate value," underscoring the role of shareholders and external stakeholders in shaping corporate conduct (Shleifer and Vishny, 1997). Similarly, (Tricker,2015) depicted corporate governance as "the system by which companies are directed and controlled, and through which they are held accountable to their owners and other stakeholders for their long-term performance, sustainability and contribution to society." This definition emphasized the importance of responsibly balancing diverse stakeholder interests and adopting a sustainable approach to corporate performance.

Further explaining the concept, (Masry, 2015) characterized corporate governance as an ensemble of mechanisms that enables management to optimize shareholder benefits. (Blair, 1995), as cited in (Abdallah, 2011), emphasized that corporate governance encompasses a range of internal policies and regulations adhered to by companies. Variations in corporate governance frameworks across countries stem from disparities in history, culture, and academic background (Sonmez and Yildırım, 2015). For instance, the USA and the UK exhibit differing standards and obligations. Effective corporate governance facilitates transparency, safeguards shareholders' rights, emphasizes long-term earnings, and holds managers accountable (Calder, 2008).

In essence, corporate governance embodies the rules, procedures, and standards governing company management and oversight, ensuring a fair balance among stakeholders' interests, including management, shareholders, creditors, suppliers, customers, and government (Palaniappan, 2017). These diverse definitions collectively underscore the intricate nature of corporate governance and emphasize the necessity of robust leadership, accountability, transparency, and stakeholder engagement to promote ethical corporate behavior and contribute to societal well-being. While a single, definitive characterization remains elusive, these definitions serve as valuable frameworks for comprehending and elevating corporate conduct and performance in pursuit of broader economic, social, and environmental sustainability goals.

Corporate Governance Key Concepts

Corporate governance encompasses a framework of regulations, practices, and processes guiding the direction and oversight of companies. Its primary aim is to ensure ethical and responsible behavior, as well as value creation for stakeholders. This section delves into pivotal concepts within corporate governance, exploring their significance in advancing corporate conduct and performance.

Accountability:

Accountability, a cornerstone of corporate governance, entails the obligation of companies, directors, and managers to act in the best interests of stakeholders and be answerable for their decisions and actions. It serves as anessentialelement for transparent, ethical, and sustainable corporate functioning. (Tricker, 2015) underscores that corporate governance revolves around accountability to resource providers, affected parties, and those essential for the company's continuity. Legal frameworks, such as the Sarbanes-Oxley Act (2002) in the US and the Companies Act (2006) in the UK, establish mechanisms to enforce accountability, imposing obligations on companies and directors (Sarbanes-Oxley Act of 2002, sec. 404; Companies Act 2006, sec. 172). The board of directors plays a crucial role in enforcing accountability by overseeing management, ensuring compliance, and addressing ethical and reputational risks.

Transparency:

Transparency, another pivotal concept, pertains to the accessibility and openness of information regarding a company's activities, performance, and decision-making processes. This transparency fosters trust and facilitates informed decision-making for stakeholders. Transparency underpins accountability, enabling stakeholders to assess performance and hold companies accountable for their actions (OECD, 2015). It encompasses financial, social, and environmental disclosures, which (Solomon, 2010) asserts are crucial for stakeholders' informed decisions. Transparency strengthens investor confidence, attracts new investments, and enhances a company's reputation. Implementing frameworks like the Global Reporting Initiative (GRI) aids companies in structured sustainability reporting, ensuring clear and accurate information distribution (Global Reporting Initiative, 2013).

Board Effectiveness:

Effective boards are essential in corporate governance, responsible for strategic direction, management oversight, compliance, and risk management. Board effectiveness centers on diverse, independent, and skilled members ensuring prudent corporate stewardship. The UK Corporate Governance Code (2018) underscores the board's critical role in setting strategy, supervising management, and stewarding shareholders (UK Corporate Governance Code, 2018). Factors like board composition, structure, processes, and practices influence effectiveness. Diverse boards with varied perspectives better address risks and opportunities (Erkens et al., 2012). Balanced representation of stakeholder interests and independence from management challenges enhance board effectiveness (Kiel & Nicholson, 2003).

Stakeholder Engagement:

Stakeholder engagement involves integrating stakeholder perspectives into decision-making processes and ensuring their interests are considered. It is vital for responsible and sustainable corporate practices and engenders trust and legitimacy. Engaging with stakeholders aids companies in comprehending expectations, preferences, and concerns, thus aligning actions with stakeholder interests (Hockerts & Wüstenhagen, 2010). Diverse engagement methods, such as employee consultations, customer feedback, and social media interactions, facilitate stakeholder involvement. A systematic approach integrating stakeholder interests, effective communication channels, and a culture valuing stakeholders' input contributes to successful stakeholder engagement (Carroll & Shabana, 2010).

In conclusion, core concepts within corporate governance - accountability, transparency, board effectiveness, and stakeholder engagement - collectively drive ethical and sustainable corporate conduct and performance. These concepts hold significance in fostering trust, enhancing decision-making, and creating value for all stakeholders. Adhering to these principles positions companies for long-term success and societal well-being.

Research Objective and Methodology

Corporate governance, representing the rules, regulations, and practices that govern stakeholder interactions, has become increasingly crucial in ensuring sustained corporate success. In the aftermath of the 2008 global financial crisis, the imperative for robust corporate governance gained prominence, prompting the imposition of more stringent regulations to avert potential crises.

This chapter is dedicated to investigating the relationship between a specific facet of corporate governance - management ownership - and its impact on the financial performance of non-takaful insurance companies in Egypt. By explaining the theoretical framework, articulating research objectives, defining research questions, formulating hypotheses, and outlining the methodology, a comprehensive exploration is undertaken to delve into this specific facet.

Theoretical Framework

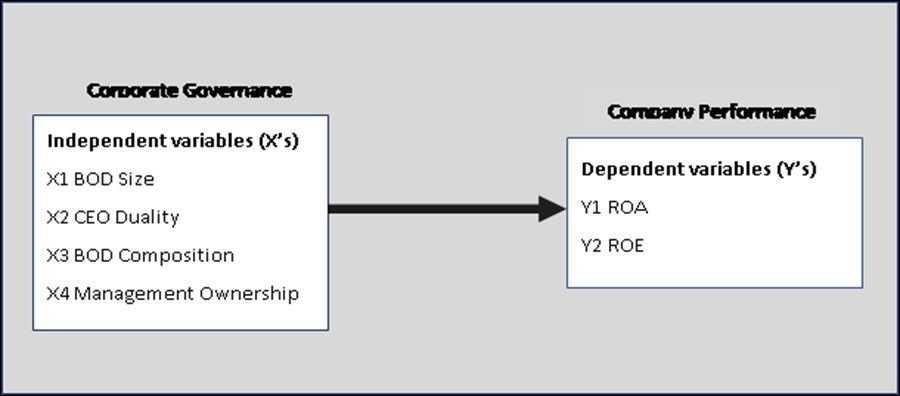

The examination of the interplay between corporate governance and financial performance in the insurance sector is discussed in a theoretical framework by prior research. The theoretical framework was based on the models implemented by (Najjar, 2012), (Dandago, 2013); (Abdallah, 2011), and (Carter et al., 2003) see (Figure 1), this framework serves as the guiding foundation.

The analysis is concentrated on assessing the influence of several variables only management ownership will be highlighted in this paper as a distinct facet of corporate governance, and the impact on financial performance, specifically measured through return on assets (ROA) and return on equity (ROE).

Figure 1

Modified Theoretical Framework by the Researcher

Source: Developed by the researcher (Abouelezz, 2023)

Research Methodology

In quest of comprehending the intricate dynamics between management ownership and financial performance, this study adopts a quantitative research design. The selected research design, employing a correlational methodology, aims to unveil intricate connections among variables. The sample includes all non-takaful insurance companies that operated within Egypt (Twenty-four) throughout the specified study timeframe (for the published fiscal years 2018-2019 till 2021-2022).

Data will be extracted from annual reports and financial statements. Independent variables include management ownership, while dependent variables comprise ROA and ROE. These variables will be analyzed through a suite of statistical tools, encompassing Spearman's rho, Mann-Whitney U test, Kruskal-Wallis test, ANOVA, and stepwise regression. Significance will be ascertained at the p<0.05 level.

Variables and Measures

In this section the findings of the study will be presented, focusing on the relationship between management ownership and the financial performance indicators ROA and ROE. It is important to note that the study initially encompassed the examination of four independent variables. However, for the purpose of this paper, the analysis centers on management ownership and its association with ROA and ROE. The inclusion of the other variables in the analysis is necessary to provide a comprehensive context for the discussion. management ownership (X4) will be measured as the percentage of shares owned by the top management. ROA and ROE will be calculated using the financial statements of the companies.

The dependent variables were calculated as follows:

Y1: Return on Assets (ROA) - calculated by dividing the net income by total assets multiplied by 100. A higher ratio indicates better performance.

Y2: Return on Equity (ROE) - calculated by dividing the net income by total shareholders’ equity multiplied by 100. A higher ratio indicates better performance.

The independent variables were defined as follows:

The following assumptions were made in this research:

A1: The insurance companies' financial year end on June 30, according to Financial Regulatory Authority (FRA).

A2: It is assumed by the researcher that the financial statements of the non-takaful insurance companies included in the study have been presented to the Financial Regulatory Authority (FRA) and subsequently approved for publication in the annual report. It is also assumed that the financial statements have not been subject to any form of accounting manipulation or improper treatment.

A3: The sample of twenty-four companies is assumed to represent the whole population for non-takaful operating in the period under study as they are registered and listed at FRA.

A4: The period under this study is four financial years starting from 2018-2019 to 2021-2022.

Limitations

While undertaking this empirical inquiry, the study acknowledges certain inherent limitations. Notably, the focus remains exclusively on examining the specific impact of management ownership on financial performance. It is recognized that other factors beyond this scope may contribute to company performance; however, these aspects lie outside the study's purview.

As the study delves into the complexities of this empirical investigation, its analysis seeks to shed light on the intricate relationship between management ownership and financial performance within the realm of non-takaful insurance companies in Egypt. Employing a rigorous methodology and insightful exploration, the study strives to reveal actionable insights that could enrich scholarly discussions and provide valuable guidance for industry practices.

Results

A notable and statistically significant positive correlation emerges between management ownership and the performance indicator ROA. The correlation analysis reveals a significant relationship between management ownership and ROA (r = .379, p = .017) See (table:1). These findings underscore a positive association between higher levels of management ownership and improved performance within non-takaful insurance companies in Egypt.

In summary, upon analyzing the results, it becomes evident that the analysis notably highlights a meaningful positive association between management ownership and performance indicators. This observation underscores the significance of aligning management interests with the financial performance trajectory of non-takaful insurance companies.

These findings carry practical implications for various stakeholders within the insurance industry, encompassing policymakers, executives, and investors. By centering their attention on management ownership as a potential lever for enhancing performance, non-takaful insurance companies can better align management incentives with the organization's long-term financial prosperity.

This study's outcomes further contribute to the existing knowledge on the intersection of corporate governance and company performance within the insurance sector.

Certain variables in the study may not follow a normal distribution or meet the assumptions required for parametric tests. To address this concern, non-parametric tests are employed, which are robust to data that may deviate from a normal distribution, as a result of conducting a normality test (Management Ownership: The Shapiro-Wilk test statistic is 0.322 with 24 degrees of freedom, and the p-value is less than 0.001. This suggests that the distribution of Management Ownership significantly deviates from a normal distribution).

These tests allow for the exploration of relationships between variables without imposing stringent assumptions, making them suitable for analyzing the data in a comprehensive and unbiased manner. Consequently, the utilization of non-parametric tests enhances the reliability and validity of the findings, ensuring a more comprehensive understanding of the study's underlying relationships.

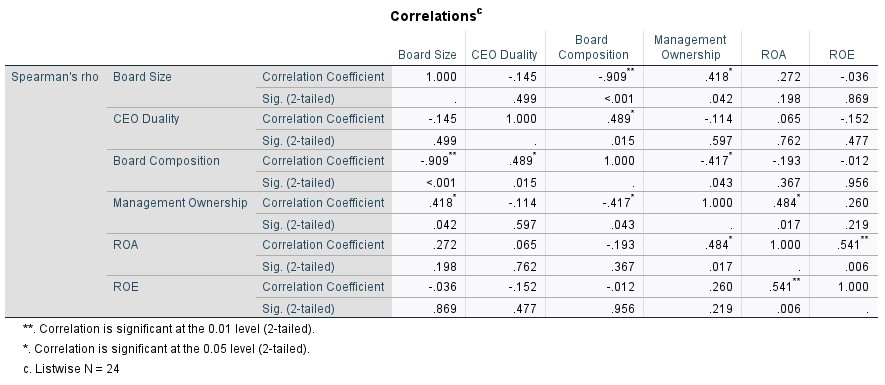

Correlation Analysis (Spearman’s Rho)

Correlation analysis measures the one-to-one relationship between any two variables, the researcher uses it to measure the one-to-one relationship between management ownership and the two dependent variables (ROA and ROE).

Spearman's rank correlation coefficient, often referred to as Spearman's Rho, is a non-parametric measure of correlation used to assess the strength and direction of the relationship between two variables. Unlike Pearson correlation, which measures the linear relationship between two continuous variables, Spearman's Rho evaluates the monotonic association between variables. Monotonicity refers to a consistent increase or decrease in the values of one variable as the values of the other variable increase or decrease, without assuming a specific linear pattern.

The resulting value of Spearman's Rho ranges from -1 to +1. A value of +1 indicates a perfect monotonic positive relationship, meaning that as one variable increases, the other variable also consistently increases in rank. A value of -1 indicates a perfect monotonic negative relationship, where one variable consistently increases in rank as the other variable decreases. A value of 0 indicates no monotonic relationship between the variables.

Spearman's Rho is particularly useful when dealing with ordinal or non-normally distributed data, providing a robust measure of association that does not require assumptions of linearity or normality. This makes it a valuable tool for exploring relationships between variables that may not conform to parametric assumptions, allowing researchers to draw meaningful insights from their data.

Table 1

Spearman’s Rho Analysis

Source: IBM SPSS Data Analysis (Abouelezz, 2023)

Based on Spearman's rho correlation coefficients, the relationship between the variables can be interpreted as follows:

Management Ownership:

In relationship with ROA: The correlation coefficient of 0.484 indicates a moderate positive monotonic relationship between management ownership and Return on Assets (ROA). A positive value suggests that as management ownership changes, there is a moderate tendency for ROA to increase. The significance level of 0.017 indicates the probability of observing such a correlation coefficient due to random chance, assuming there is no actual relationship between management ownership and ROA. In this case, since the p-value is less than the commonly chosen significance level of 0.05 (or 5%), the result is statistically significant. Based on the obtained results, Spearman's rank correlation analysis shows a moderate positive monotonic relationship between management ownership and Return on Assets (ROA). The correlation coefficient of 0.484, combined with the statistically significant p-value (0.017), suggests that there is a meaningful and reliable association between management ownership and ROA.

In relationship with ROE: The correlation coefficient of 0.260 indicates a weak positive monotonic relationship between management ownership and Return on Equity (ROE). A positive value for ρ suggests that as management ownership increases, there is a slight tendency for ROE to increase as well, but the correlation is weak. The significance level of 0.219 indicates the probability of observing such a correlation coefficient due to random chance, assuming there is no actual relationship between management ownership and ROE. In this case, since the p-value is greater than the commonly chosen significance level of 0.05 (or 5%), the result is not statistically significant.it means that the data does not provide enough evidence to conclude that the observed relationship between the variables is unlikely to occur by chance alone.

In conclusion:

There is a significant positive correlation between Management Ownership and ROA (0.484, p < 0.05).

There is no significant correlation between Management Ownership and ROE (0.260, p > 0.05).

These results indicate that Management Ownership shows a significant correlation with ROA. Specifically, there is a positive correlation between Management Ownership and ROA, suggesting that higher levels of Management Ownership may be associated with higher returns on assets. However, there is no significant correlation with ROE.

Discussion

This section provides an insightful interpretation of the research findings, focusing exclusively on the specific impact of management ownership on the financial performance of non-takaful insurance companies in Egypt. The comprehensive analysis and exploration aim to shed light on the nuanced interplay between management ownership and financial performance, offering valuable insights that contribute to both scholarly discourse and practical industry guidance.

The research findings underscore a significant positive correlation between management ownership and one of the core performance indicators, Return on Assets (ROA). This compelling association highlights the pivotal role that management ownership plays in fostering improved financial performance.

The implications of this focal finding resonate across various dimensions of the non-takaful insurance industry, particularly with policymakers, industry practitioners, and stakeholders. The elevated levels of management ownership observed in this study illuminate a promising avenue for enhancing the financial performance of non-takaful insurance companies. By nurturing a sense of ownership and alignment with shareholders, higher management ownership appears to be a catalyst for driving improved ROA – a dynamic that holds the potential to reshape industry practices and drive sustainable growth (Smith et al., 2022). It is recommended to establish robust monitoring and evaluation mechanisms for regular assessment of both performance and corporate governance practices. Regular reviews, industry benchmarking, and external assessments can provide valuable insights (Johnson, 2020).

It is also important to consider industry-specific factors by customizing corporate governance practices to address unique challenges within the insurance sector. Comply with regulations, stay updated on industry trends, and draw lessons from successful peers to optimize governance strategies (Davis & James, 2019).

This study sets the groundwork for further research in the insurance non-takaful sector. Future studies could explore variables like board diversity, executive compensation, and risk management practices for more comprehensive performance analysis (Lee et al., 2023).

It is essential to recognize the limitations inherent in this study. The exploration into the impact of management ownership, while illuminating, is not without its constraints. The relatively small sample size and the potential biases stemming from data availability and quality warrant consideration. Furthermore, the specific context of non-takaful insurance companies in Egypt may temper the generalizability of these findings to broader industry contexts.

In conclusion, this study's focused examination of the impact of management ownership on the financial performance of non-takaful insurance companies in Egypt significantly contributes to the existing body of knowledge. The findings emphasize the pivotal role of management ownership in shaping financial performance dynamics. These insights hold promise not only for advancing scholarly discourse but also for offering practical guidance to industry stakeholders who seek to leverage management ownership as a strategic lever for enhancing performance, aligning interests, and fostering sustainable growth in the non-takaful insurance sector.

Conclusions

In assessing the impact of various independent variables on the performance indicators of insurance non-takaful companies, this study yielded noteworthy insights. Notably, the study found that a significant positive correlation emerged between management ownership and performance indicator (ROA). This correlation underscores the significance of aligning management's interests with the company's financial performance.

By shedding light on the nuanced interplay between corporate governance factors and performance, this study contributes to the existing body of knowledge within the insurance industry. While certain factors exhibited limited influence, the crucial role of management ownership in enhancing the financial performance of insurance non-takaful companies is evident.

The implications extend beyond academia, touching stakeholders in the insurance sector such as policymakers, executives, and investors. By emphasizing management ownership as a strategic lever, insurance non-takaful companies can cultivate better alignment between managerial motivations and the organization's long-term financial prosperity.

Furthermore, this study paves the way for future research endeavors in the insurance non-takaful sector. Subsequent studies could delve into other variables, including board diversity, executive compensation, and risk management practices, in order to glean a more comprehensive understanding of performance drivers.

Ultimately, the implementation of the recommendations derived from this study holds the potential to elevate the overall performance and corporate governance practices of insurance non-takaful companies, fostering improved financial outcomes and bolstering stakeholder confidence.

References

Abbott, L. J., Parker, S., & Peters, G. F. (2004). Audit committee characteristics and restatements. Auditing: A Journal of Practice & Theory, 23(2), 69-87.

Abuzayed, B. (2019). Corporate governance and performance: evidence from the insurance sector in Jordan. Journal of Economic and Administrative Sciences, 35(1), 42-53.

Abdallah, A.A.K. (2011). Relationship between Corporate Governance and Banks’ Performance in Egypt. (MBA Thesis). Maastricht School of Management, Maastricht, Netherlands.

Abdallah, D. (2011). Corporate Governance and Portfolio Return in Egyptian Stock Market. (MBA Thesis). Maastricht School of Management, Maastricht, Netherlands.

Abdel Maguid, M., (2016). Understanding the Corporate Governance Impact on The Corporates' Performance in Egypt. Maastricht School of Management, Maastricht, Netherlands.

Abdel-Maksoud, A. and El-Kassar, A. (2021). The impact of regulatory reforms on corporate governance practices among Egyptian insurers. Journal of Accounting and Finance, 21(2), 59-72.

Abdullah, H., Valentine, B., (2009). Fundamental and Ethics Theories of Corporate Governance. Middle Eastern Finance and Economics. ISSN: 1450-2889 Issue 4 (2009) © EuroJournals Publishing, Inc. 2009

Abdullah, A. A., & Hussainey, K. (2020). Corporate governance and risk management practices in the Egyptian insurance sector. Journal of Financial Reporting and Accounting, 18(1), 41-58.

Adams, R. B., Almeida, H., & Ferreira, D. (2016). Powerful independent directors. Review of Financial Studies, 29(11), 2933-2968.

Adams, R. B., & Mehran, H. (2005). Corporate performance, board structure, and its determinants in the banking industry. Federal Reserve Bank of New York Staff Reports, (215).

Agrawal, A., &Knoeber, C. R. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. Journal of Financial and Quantitative Analysis, 31(3), 377-397.

Ahern, K. R., & Dittmar, A. K. (2012). The changing of the boards: The impact on firm valuation of mandated female board representation. Quarterly Journal of Economics, 127(1), 137-197.

Ahmad, I., & Farooq, S. (2021). Corporate governance and financial performance: A systematic review and future research agenda. Corporate Governance: The International Journal of Business in Society, 21(2), 390-407.

Ahmed, A. S., & Hossain, M. (2021). The impact of corporate governance on financial performance: evidence from banking sector of Bangladesh. International Journal of Business and Management, 16(3), 63-74.

Al-Shaer, H., & Taman, H. (2016). Corporate governance and firm performance in the Egyptian insurance industry. International Journal of Business and Management, 11(2), 199-215.

Ameer, R., Othman, R., & Abdul-Rahman, A. R. (2018). Corporate governance and firm performance in emerging markets: Evidence from Malaysia. Pacific-Basin Finance Journal, 51, 198-217.

Anwar, M. F., Hussain, S. T., & Khan, M. A. (2020). Corporate governance and financial performance: evidence from insurance companies of Pakistan. Future Business Journal, 6(1), 1-14.

Bhagat, S., & Black, B. (2002). The non-correlation between board independence and long-term firm performance. Journal of Corporation Law, 27(2), 231-273.

Becht, M., Bolton, P., & Roell, A. (2002). Corporate governance and control. Handbook of the economics of finance, 1, 1-109.

Berman, S. L., Wicks, A. C., Kotha, S., & Jones, T. M. (1999). Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Academy of Management Journal, 42(5), 488-506.

Black, B. (2001). The rise of institutional investors as universal owners. Oxford Review of Economic Policy, 17(2), 183-199.

Bohren, O., & Staubo, S. (2014). Does mandatory gender balance work? Changing organizational form to avoid board upheaval. Journal of Corporate Finance, 28, 152-168.

Boubakri, N., (2011). Corporate Governance and Issues from the Insurance Industry. © The Journal of Risk and Insurance, 2011, Vol. 78, No. 3, 501-518. DOI: 10.1111/j.1539-6975.2011.01429. x.

Brav, A., Jiang, W., Partnoy, F., & Thomas, R. (2008). Hedge fund activism, corporate governance, and firm performance. Journal of Finance, 63(4), 1729-1775.

Cadbury, A. (1992). Report of the committee on the financial aspects of corporate governance. Gee & Co.

Choi, H., Lee, J., & Park, K. (2012). Corporate governance and firm value: Evidence from the Korean insurance industry. Journal of Risk and Insurance, 79(3), 595-623.

Calder, A., (2008). Corporate governance: A practical guide to the legal frameworks and international codes of practice. London; Philadelphia: Kogan Page.

Carroll, A. B., & Shabana, K. M. (2010). The business case for corporate social responsibility: A review of concepts, research, and practice. International

Clarke, R., & Dean, G. (2007). The association between corporate governance and performance in the UK insurance industry. The Journal of Risk Finance, 8(3), 246-259.

Clarke, T. (2004). Theories of corporate governance: The philosophical foundations of corporate governance. Routledge.

Carroll, A. B. (1979). A three-dimensional conceptual model of corporate performance. Academy of Management Review, 4(4), 497-505.

Coffee, J. C. (2012). The future as history: the prospects for global convergence in corporate governance and its implications. Northwestern Journal of International Law & Business, 32(3), 499-543.

Cornforth, C., & Brown, W. A. (2003). The governance of cooperatives and mutual associations: A paradox perspective. Annals of Public and Cooperative Economics, 74(4), 519-550.

Cummins, J. D., Phillips, R. D., & Weiss, M. A. (2006). The incentive effects of monopoly power on corporate performance. Journal of Banking & Finance, 30(5), 1353-1376.

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm. Englewood Cliffs, NJ: Prentice-Hall.

Daily, C. M., Dalton, D. R., & Cannella Jr, A. A. (2003). Corporate governance: Decades of dialogue and data. Academy of Management Review, 28(3), 371-382.

Dandago, D.K.I., (2013). Impact of Corporate Governance Mechanisms on the Financial Performance of Listed Insurance Firms in Nigeria. International conference on Luca Pacioli in accounting history and 3rd Balkans and middle east countries, June (2013). Retrieved from http://dergipark.gov.tr/download/article-file/319860

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management Review, 22(1)

Davis, E. P., & van der Werf, M. (2014). Corporate governance and performance in the wake of the financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 27, 332-350.

Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111-203, 124 Stat. 1376 (2010).

Donaldson, T., & Davis, J. H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1), 49-64.

Donaldson, T., & Preston, L. E. (1995). The stakeholder theory of the corporation: Concepts, evidence, and implications. Academy of Management Review, 20(1), 65-91

Economic Research Forum. (2018). Egypt: Insurance sector dynamics. Retrieved from https://erf.org.eg/wp-content/uploads/2018/12/INSURANCE-SECTOR-DYNAMICS-Egypt.pdf

El-Gammal, W. (2019). The insurance sector as a contributor to economic development: A case study of Egypt. International Journal of Economics, Commerce and Management, 7(1), 1-11.

El-Habashy, M., & Abdel-Salam, O. (2016). Corporate governance and financial performance of insurance companies in Egypt. Journal of Insurance and Financial Management

El-Masry, A. A. (2013). Corporate governance and performance of Egyptian insurance companies. Journal of Economic and Administrative Sciences, 29(1), 1-27.

El-Masry, A., & Abdelfattah, T. (2017). Corporate governance and financial performance of non-takaful insurance companies in Egypt. Managerial Finance, 43(12), 1454-1470.

El-Masry, A. A., & Abdel-Kader, M. G. (2014). Corporate governance and the financial performance of Egyptian banks.Journal of Applied Accounting Research, 15(1), 82-97.

El-Said, H. and Salem, M. (2020). The role of board diversity in corporate governance: Evidence from the Egyptian insurance sector. Journal of Risk and Financial Management, 13(11), 272.

Elsas, R., & Florysiak, D. (2016). Corporate governance and debt maturity: International evidence. Journal of Corporate Finance, 38, 157-173.

Elsayed, M. A., & Ismail, W. E. (2018). Corporate governance, risk, and profitability: Evidence from the Egyptian insurance industry. Journal of Financial Reporting and Accounting, 16(2), 177-196.

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of management review, 14(1), 57-74.

Erkens, D. H., Hung, M., & Matos, P. (2012). Corporate governance in the 2007-2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 18(2), 389-411.

Fahmy, H. A., & Hegazy, M. A. (2020). The impact of corporate governance on financial performance: an empirical analysis of the insurance sector in Egypt. Journal of Financial Reporting and Accounting, 18(4), 574-590.

Fakry, K. and El-Khazindar, K. (2021). The impact of ownership structure on corporate governance: Evidence from the Egyptian insurance sector. Research in International Business and Finance, 56, 101330.

Faleye, O., Hoitash, R., & Hoitash, U. (2011). The costs and benefits of appointing friends and family to boards of directors. Journal of Business Ethics, 103(3), 413-429.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325.

Galbraith, C. S. (2006). Sarbanes-Oxley Act: unintended consequences of the “corporate transparency” law. Journal of Business Ethics, 67(2), 143-152.

Gelter, M. (2011). The failure of corporate law: fundamental flaws and progressive possibilities. Cambridge University Press.

Ghoshal, S., & Moran, P. (1996). Bad for practice: A critique of the transaction cost theory. Academy of Management Review, 21(1), 13-47.

Gillan, S. L., & Martin, J. D. (2016). Corporate governance post-Enron: Comparative and international perspectives. John Wiley & Sons.

Global Reporting Initiative. (2013). Sustainability reporting guidelines. Retrieved from https://www.globalreporting.org/Pages/default.aspx

Gulati, R. (1995). Social structure and alliance formation patterns: A longitudinal analysis. Administrative Science Quarterly, 40(4), 619-652.

Hardy, C. (1996). Power and politics in organizations. Sage.

Hillman, A. J., & Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: What's the bottom line? Strategic Management Journal, 22(2), 125-139.

Huynh, L. T., Tran, V. T., & Le, H. P. (2021). The impact of corporate governance on firm performance: Evidence from insurance companies in emerging markets. Emerging Markets Review, 46, 101059.

Ibrahim, N. A., & Angelidis, J. P. (2015). Corporate governance and corporate performance: A study of Greek firms. Journal of Applied Accounting Research, 16(3), 316-335.

Insurance Federation of Egypt (IFE). (2020). Annual report 2019. Retrieved from http://www.ife-egypt.org/wp-content/uploads/2020/11/IFE-Annual-Report-2019.pdf

Ismail, S., & El-Gammal, W. (2018). Corporate governance, risk management and financial performance: evidence from Egyptian insurance companies. Journal of Risk and Financial Management, 11(4), 79.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360.

Jensen, M. C., & Murphy, K. J. (1990). Performance pays and top-management incentives. Journal of political economy, 98(2), 225-264.

Kahya, E., & Ozkan, N. (2019). Does board independence matter for firm value? Evidence from Turkish listed firms. Corporate Governance: The International Journal of Business in Society, 19(6), 1206-1226.

Kordonska, S., & Kostadinova, R. (2018). Transparency and corporate governance. Economic Alternatives, 1, 102-113.

Kumar, R., & Singh, J. P. (2018). An analysis of the Cadbury report: Its implications on corporate governance practices worldwide. Global Business Review, 19(2), 301-314

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (2000). Investor protection and corporate governance. The Journal of Financial Economics, 58(1-2), 3-27.

Lawrence, P. R., & Lorsch, J. W. (1967). Organization and environment: Managing differentiation and integration. Harvard University Press.

Lorsch, J. W., & MacIver, E. (1989). Pawns or potentates: The reality of America's corporate boards. Harvard Business Review, 67(2), 104-113.

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of Management Review, 26(1), 117-127.

Millstein, I. M. (1998). Corporate governance: Improving competitiveness and access to capital in global markets. Business Economics, 33(4), 7-10.

Mizruchi, M. S., & Fein, L. C. (1999). The social construction of organizational knowledge: A study of the uses of coercive, mimetic, and normative isomorphism. Administrative Science Quarterly, 44(4), 653-683.

Monks, R. A. G., & Minow, N. (2011). Corporate governance. John Wiley & Sons.

Mudawi, H. M. A., & Abdelgadir, M. A. (2016). Corporate governance and financial performance in Sudanese insurance companies. Journal of Accounting and Management Information Systems, 15(2), 321-338.

Najjar, N.J., (2012). The Impact of Corporate Governance On The Insurance Firm’s Performance In Bahrain. International Journal of Learning & Development. Vol.2, no. 2. Retrieved from https://doi.org/10.5296/ijld.v2i2.1412

Narayanan, R., & Rajarao, V. (2021). Corporate governance in insurance companies: Issues and challenges. Journal of Insurance Regulation, 40(4), 78-96.

Nguyen, T. M. H., & Nguyen, P. T. H. (2020). Corporate governance and firm performance: evidence from Vietnam. Journal of Asian Business and Economic Studies, 27(1), 79-90.

Oduwole, J. (2015). Corporate governance: Accountability, transparency, and ethical conduct. International Journal of Economics, Commerce and Management, 3(7), 1-18.

OECD. (1999). Principles of Corporate Governance. OECD Publishing.

OECD. (2015). OECD Principles of Corporate Governance. Retrieved from https://www.oecd.org/daf/ca/corporategovernanceprinciples/Corporate-Governance-Principles-ENG.pdf

Palaniappan, G., (2017). Determinants of Corporate Financial Performance Relating to Board Characteristics of Corporate Governance in India Manufacturing Industry: An empirical study, European Journal of Management and Business Economics, Vol. 26 Issue: 1, pp.67-85, Retrieved from: https://doi.org/10.1108/EJMBE-07-2017-005.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. Harper & Row.

PwC. (2014). Corporate governance in insurance: Building public trust and confidence. Retrieved from https://www.pwc.com/gx/en/insurance/publications/assets/pwc-corporate-governance-in-insurance-building-public-trust-and-confidence.pdf

Saha, S. (2017). The emergence of corporate governance: A historical perspective. Corporate Governance, 17(4), 578-588.

Sarbanes-Oxley Act of 2002, Pub. L. No. 107-204, 116 Stat. 745 (2002).

Sherif, M., Elsayed, M., (2013). The impact of corporate characteristics on capital structure: evidence from the Egyptian insurance companies 27.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. Journal of Finance, 52(2), 737-783.

Solomon, J. (2010). Corporate governance and accountability. John Wiley & Sons Ltd.

Sonmez, D.M., Yildırım, S., (2015). A Theoretical Aspect on Corporate Governance and Its Fundamental Problems: Is It a Cure or Another Problem in the Financial Markets? Journal of Business Law and Ethics https://doi.org/10.15640/jble.v3n1a2

Sood, M., )2015(. Corporate governance and the performance of banking and insurance sector in India: an empirical analysis. International Journal of Research in Commerce & Management. Vol. 6, Iss. 2. Retrieved from https://eds.b.ebscohost.com/eds/detail/detail?vid=3&sid=4c7216b4-2e38-44d8-8489-b0ac6275c26d%40pdc-v-sessmgr02&bdata=JnNpdGU9ZWRzLWxpdmU%3d#AN=119728747&db=bsu

Stowell, D. B. (2012). Dodd-Frank Wall Street Reform and Consumer Protection Act: a summary. Journal of Investment Compliance, 13(1), 5-18

Tricker, B. (2015). Corporate governance: Principles, policies, and practices. Oxford University Press.

Tricker, B. (2020). Corporate governance: Principles, policies, and practices. Oxford University Press.

Wallison, P. J. (2006). Sarbanes-Oxley: costs, benefits, and business impacts. Journal of Applied Corporate Finance, 18(4), 72-81.

Ward, D., (2003). Can Independent Distribution Function as a Mode of Corporate Governance? An Examination of the UK Life Insurance Market. Journal of Management and governance. Vol. 7, pp. 361-384.

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185-211.

Yermack, D. (2010). Corporate governance and shareholder activism. Review of Finance, 14(1), 1-23.

Zahra, S. A., & Pearce, J. A. (1989). Boards of directors and corporate financial performance: A review and integrative model. Journal of Management, 15(2), 291-334.

Author: Rania Abouelezz, student LIGS University

Approved by: Dr. Minh Nguyen, lecturer LIGS University