The Relationship Between Corporate Governance and Financial Performance in Insurance Companies in Egypt

This paper presents a comprehensive review of both theoretical and empirical literature concerning the relationship between corporate governance and financial performance. Drawing from the work of (Abouelezz, 2023) in "The Relationship Between Corporate Governance and Financial Performance in Insurance Companies in Egypt," this review delves into the connections between these two critical facets within the context of the Egyptian insurance sector.

The primary objective is to analyze the existing body of literature that sheds light on the interplay between corporate governance practices and financial performance outcomes, tailored to the unique regulatory landscape and economic dynamics of the Egyptian insurance market. This review seeks to offer readers an in-depth grasp of the evolving discourse surrounding corporate governance and its implications for the financial performance of insurance enterprises.

Corporate governance serves as the cornerstone of effective organizational management, establishing the framework that guides a company's direction and operation. This paper is particularly intended forresearchers, scholars, practitioners, policymakers, and stakeholders interested in corporate governance, financial performance, and the specific context of the Egyptian insurance industry.

Core Analysis:

(Abouelezz, 2023) study explores the relationship between corporate governance and financial performance in non-takaful insurance companies operating in Egypt. Non-takaful insurance firms pertain to conventional insurance enterprises functioning based on conventional principles, differing from takaful insurance firms adhering to Islamic principles. The study addresses a significant gap in the literature by focusing specifically on the Egyptian insurance industry, where research in this area has been limited. The research methodology employed both non-parametric and parametric tests to analyze data extracted from financial reports and corporate governance disclosures of twenty-four insurance companies in Egypt operating during the period of study.

(Abouelezz, 2023) serves as a cornerstone in the exploration of corporate governance's multifaceted impact on organizational performance. Through a comprehensive analysis, the study underscores the pivotal role of corporate governance mechanisms in shaping the strategic direction, decision-making processes, and overall success of companies. By examining various dimensions of corporate governance, Abouelezz's research sheds light on the interplay between governance practices and organizational outcomes. In this context, this section delves deeper into the theories that underpin effective corporate governance, further enriching the understanding of the intricate relationships between management, shareholders, and stakeholders within organizations.

(Abouelezz, 2023) employs various theoretical frameworks to contextualize and analyze the relationship between corporate governance mechanisms and financial performance. These theories offer insights into the dynamics within non-takaful insurance companies:

Agency Theory:

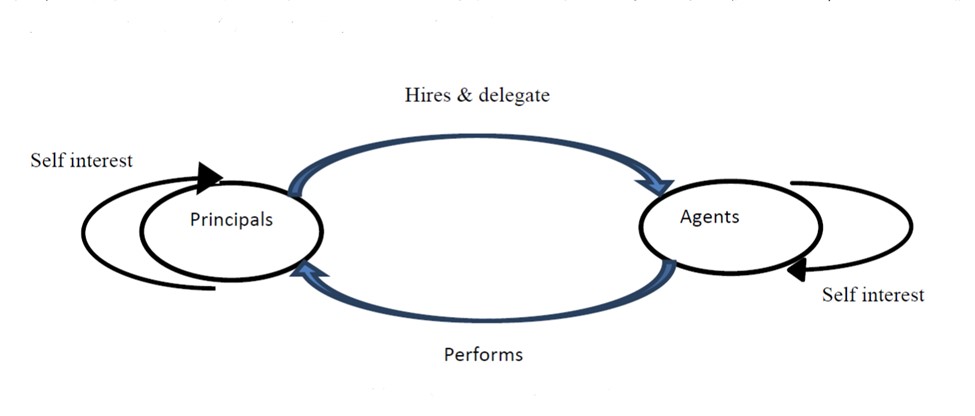

Agency theory delves into the principal-agent relationship, where managers (agents) act on behalf of shareholders (principals). It emphasizes the potential conflicts of interest that can arise when agents pursue personal goals at the expense of shareholders' interests. The theory highlights the importance of aligning incentives, monitoring mechanisms, and governance structures to mitigate such conflicts (Figure1). Agency theory's focus on aligning interests and reducing information asymmetry contributes to enhancing transparency, accountability, and ultimately, organizational performance (Jensen & Meckling, 1976).

Figure 1

Corporate Governance – Agency Theory

Source: (Abdullah & Valentine,2009)cited in (Abouelezz, 2023)

Stewardship Theory:

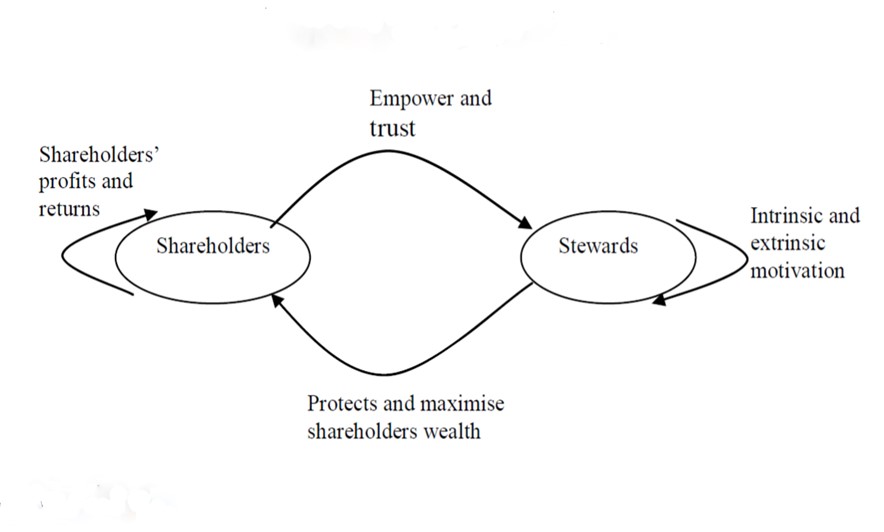

In contrast to agency theory, stewardship theory emphasizes the inherent motivation of managers to act as responsible stewards of shareholders' resources. Managers are viewed as individuals who genuinely prioritize the well-being of the organization and its stakeholders (Figure 2). This theory underscores the significance of fostering a positive organizational culture and providing managers with greater autonomy and responsibilities. Stewardship theory posits that trust-based relationships between management and shareholders can lead to improved decision-making, efficiency, and long-term performance (Donaldson & Davis, 1991).

Figure 2

Corporate Governance – Stewardship Theory

Source: (Abdullah & Valentine, 2009)cited in (Abouelezz, 2023)

Stakeholder Theory:

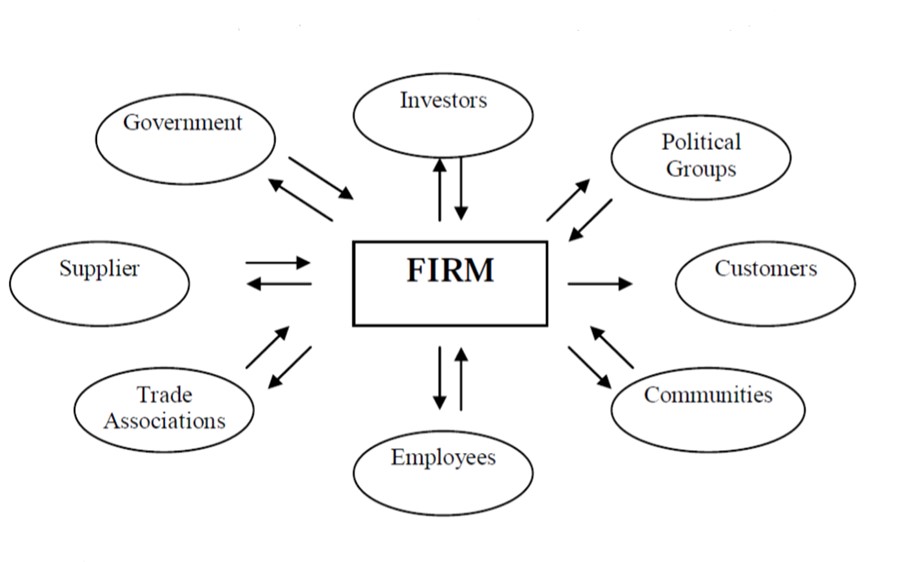

Stakeholder theory broadens the perspective of corporate governance by recognizing the diverse interests of various stakeholders, including employees, customers, suppliers, and the community (Figure3). This theory contends that corporate governance should extend beyond shareholders to address the concerns of all stakeholders. By actively considering and involving the interests of multiple parties, organizations can enhance their reputation, build stronger relationships, and promote sustainability. Stakeholder theory aligns corporate governance practices with ethical and social responsibilities, ultimately contributing to holistic performance and value creation (Freeman, 1984).

Figure 3

Corporate Governance – Stakeholder Theory

Source: (Donaldson & Preston, 1995) cited in (Abdullah & Valentine, 2009)cited in (Abouelezz, 2023)

Resource Dependence Theory:

Resource dependence theory highlights the interdependence between organizations, including insurance companies, and their external environment. It emphasizes how these organizations rely on external resources such as capital, knowledge, and legitimacy to thrive and remain competitive in their respective industries. In the context of non-takaful insurance companies, the "firm" refers to the specific insurance company being studied. The theory underscores the role of corporate governance mechanisms in effectively managing these external dependencies. By maintaining a diverse network of relationships with stakeholders, including customers, regulators, and investors, and ensuring transparent communication, insurance companies can reduce their vulnerability to external pressures and adapt to dynamic changes in the market environment. This adaptation positively influences the overall performance of the insurance company (Pfeffer & Salancik, 1978).

These theories, including the Resource Dependence Theory, collectively contribute to a multifaceted understanding of corporate governance's intricate dynamics and its profound impact on the performance of insurance companies. While agency theory and stewardship theory delve into the roles and motivations of managers within insurance companies, stakeholder theory highlights the broader social responsibilities that insurance companies have towards various stakeholders. The Resource Dependence Theory specifically underscores how insurance companies navigate their external dependencies to maintain their performance in a dynamic environment. (Abouelezz, 2023) study offers a comprehensive understanding of the intricate relationship between corporate governance and financial performance in non-takaful insurance companies in Egypt. The exploration of mechanisms alongside theoretical frameworks enriches the analysis and contributes to the broader literature on corporate governance and organizational outcomes.

To establish the critical context for this study, an overview of corporate governance within the insurance industry is also explored.Corporate governance, essential for enhancing market confidence and preventing fraud, is pivotal in establishing a balance of interests among stakeholders (Lipman & Lipman, 2006). This equilibrium is a fundamental element of confidence-building in companies and their financial performance (Shehata, 2011). In the insurance sector, corporate governance assumes an even more significant role due to the requirement of fair and transparent operations, governed by strict rules and guidelines. Given the industry's substantial impact on diverse sectors and its role as a safety net against unforeseen events, it is dominant that insurance companies adhere to sound governance practices tailored to their unique risk profiles and responsibilities (OECD, 2004).

The key corporate governance indicators under investigation include board size, CEO duality, board composition, and management ownership. The study's unique focus on management ownership is particularly noteworthy, as it stands out as a crucial factor influencing the financial performance of non-takaful insurance companies in Egypt. By analyzing Return on Assets (ROA) and Return on Equity (ROE) as financial performance metrics, Abouelezz provides valuable insights into the effects of corporate governance practices on these outcomes.

The findings of the study reveal that management ownership demonstrates a significant impact on ROA, underscoring its importance as a determinant of financial performance in the non-takaful insurance sector. However, other corporate governance indicators such as board size, CEO duality, and board composition did not exhibit a statistically significant relationship with financial performance metrics. This suggests that while these indicators may hold relevance in other contexts, their impact on financial performance within the studied sector is limited. This underscores the contextual nature of corporate governance's influence, where certain aspects may be more pertinent than others in the specific context of the Egyptian non-takaful insurance industry.

Moreover, the research conducted by Abouelezz contributes to both theoretical and practical domains. By focusing on the Egyptian insurance industry, the study offers insights that can inform policy decisions, corporate practices, and investment strategies. The significance of aligning management ownership with performance goals is highlighted, emphasizing its potential to optimize financial outcomes. These insights serve as a foundation for policymakers seeking to develop targeted regulations and policies to enhance corporate governance practices in the insurance sector. Additionally, insurance companies can leverage the findings to drive better financial performance, and investors can make informed decisions based on the study's implications.

In summary, (Abouelezz, 2023) research provides a thorough examination of the complex relationship between corporate governance and financial performance in the context of non-takaful insurance companies in Egypt. The study's unique focus on management ownership as a key element influencing financial outcomes contributes to the understanding of corporate governance practices within this sector. The findings hold practical implications for policymakers, insurance companies, and investors, offering a pathway for enhancing the financial health of the Egyptian insurance industry.

Conclusions and Recommendations

In conclusion, the review of "The Relationship Between Corporate Governance and Financial Performance in Insurance Companies in Egypt" by (Abouelezz, 2023) sheds light on the interplay between corporate governance practices and financial performance outcomes in the Egyptian insurance sector. The study's comprehensive analysis of board size, CEO duality, board composition, and management ownership within the context of non-takaful insurance companies presents valuable insights beyond the sector.

In terms of the connection between performance indicators and various independent variables, the analysis performed Kruskal-Wallis and Mann-Whitney U tests to assess the relationship between board size, CEO duality, board composition, and management ownership with return on assets (ROA) and return on equity (ROE) in insurance non-takaful companies. The results indicated that there is no statistically significant association between board size and performance indicators, as indicated by p-values of 0.231 for ROA and 0.589 for ROE. Similarly, CEO duality showed no significant connection with performance indicators, with p-values of 0.797 for ROA and 0.652 for ROE. Likewise, board composition in terms of independent directors did not exhibit a significant impact on performance, with p-values of 0.398 for ROA and 0.709 for ROE.However, a noteworthy discovery was a positive correlation between management ownership and ROA. Correlation analysis revealed a meaningful relationship between management ownership and ROA (r = 0.379, p = 0.017), suggesting that higher levels of management ownership are linked to enhanced performance in insurance non-takaful companies.

This study bridges a critical gap in the existing literature by focusing specifically on the Egyptian insurance industry, which has been underexplored in this context.The strengths of the researcher's dissertation lie in its unique focus on management ownership and its association with Return on Assets (ROA). By investigating this underexplored area, the study uncovers a significant relationship that carries practical implications for enhancing financial performance. The study's research methodology, which combines both non-parametric and parametric tests, contributes to the credibility of its findings.However, acknowledging the inherent nature of research, certain limitations warrant consideration. The study's sample size of twenty-four insurance companies in Egypt, although representing the entire non-takaful sector, suggests the need for cautious generalization of the findings to a broader context. Furthermore, while the study effectively explores the relationship between management ownership and financial performance, its examination of other corporate governance indicators presents opportunities for further exploration.

Despite these limitations, the study's implications are notable. Policymakers can utilize the findings to formulate targeted regulations that promote optimal corporate governance practices within the Egyptian insurance industry. Insurance companies can integrate the insights to drive strategic decisions that improve financial performance, and investors can leverage this knowledge to inform investment strategies.

These findings contribute to the existing literature on corporate governance and company performance within the insurance industry. Although some factors like board size and composition may not strongly drive performance, the study underscores the crucial role of management ownership in improving financial outcomes.These findings have practical implications for stakeholders in the insurance industry, including policymakers, executives, and investors. The study suggests that fostering higher levels of management ownership can better align management's interests with the company's long-term financial success.

Based on these findings, several recommendations are made by the researcher for enhancing the performance and corporate governance practices of insurance non-takaful companies:

Enhance Management Ownership: Given the positive correlation between management ownership and performance, insurance non-takaful companies should implement strategies to encourage greater management ownership. This can help align management interests with long-term financial success.

Strengthen Board Effectiveness: Despite the lack of significant associations, insurance non-takaful companies should focus on improving board effectiveness by promoting diverse perspectives, enhancing communication, and ensuring the active involvement of independent directors.

Continuous Monitoring and Evaluation: Companies should establish robust mechanisms for monitoring and evaluating performance and governance practices. This includes periodic reviews of key performance indicators, benchmarking against industry standards, and seeking external assessments.

Consider Industry-specific Factors: Given industry nuances, insurance non-takaful companies should tailor governance practices to address industry-specific challenges, such as compliance with regulations and adoption of best practices.

Future Research Directions: The study suggests further research into other variables like board diversity, executive compensation, and risk management to gain a comprehensive understanding of performance drivers in the insurance non-takaful sector.By implementing these recommendations, insurance non-takaful companies can enhance overall performance and governance practices, leading to improved financial outcomes and stakeholder confidence.

In conclusion, Abouelezz's research advances the understanding of the connection between corporate governance and financial performance in the Egyptian insurance sector. The study's contributions pave the way for future research to delve deeper into related indicators, fostering a comprehensive comprehension of the mechanisms underlying these relationships. The review underscores the significance of aligning corporate governance practices with financial objectives, presenting a roadmap for advancing the performance of non-takaful insurance companies in Egypt.

Abbott, L. J., Parker, S., & Peters, G. F. (2004). Audit committee characteristics and restatements. Auditing: A Journal of Practice & Theory, 23(2), 69-87.

Abuzayed, B. (2019). Corporate governance and performance: evidence from the insurance sector in Jordan. Journal of Economic and Administrative Sciences, 35(1), 42-53.

Abdallah, A.A.K. (2011). Relationship between Corporate Governance and Banks’ Performance in Egypt. (MBA Thesis). Maastricht School of Management, Maastricht, Netherlands.

Abdallah, D. (2011). Corporate Governance and Portfolio Return in Egyptian Stock Market. (MBA Thesis). Maastricht School of Management, Maastricht, Netherlands.

Abdel Maguid, M., (2016). Understanding the Corporate Governance Impact on The Corporates' Performance in Egypt. Maastricht School of Management, Maastricht, Netherlands.

Abdel-Maksoud, A. and El-Kassar, A. (2021). The impact of regulatory reforms on corporate governance practices among Egyptian insurers. Journal of Accounting and Finance, 21(2), 59-72.

Abdullah, H., Valentine, B., (2009). Fundamental and Ethics Theories of Corporate Governance. Middle Eastern Finance and Economics. ISSN: 1450-2889 Issue 4 (2009) © EuroJournals Publishing, Inc. 2009

Abdullah, A. A., & Hussainey, K. (2020). Corporate governance and risk management practices in the Egyptian insurance sector. Journal of Financial Reporting and Accounting, 18(1), 41-58.

Adams, R. B., Almeida, H., & Ferreira, D. (2016). Powerful independent directors. Review of Financial Studies, 29(11), 2933-2968.

Adams, R. B., & Mehran, H. (2005). Corporate performance, board structure, and its determinants in the banking industry. Federal Reserve Bank of New York Staff Reports, (215).

Agrawal, A., &Knoeber, C. R. (1996). Firm performance and mechanisms to control agency problems between managers and shareholders. Journal of Financial and Quantitative Analysis, 31(3), 377-397.

Ahern, K. R., & Dittmar, A. K. (2012). The changing of the boards: The impact on firm valuation of mandated female board representation. Quarterly Journal of Economics, 127(1), 137-197.

Ahmad, I., & Farooq, S. (2021). Corporate governance and financial performance: A systematic review and future research agenda. Corporate Governance: The International Journal of Business in Society, 21(2), 390-407.

Ahmed, A. S., & Hossain, M. (2021). The impact of corporate governance on financial performance: evidence from banking sector of Bangladesh. International Journal of Business and Management, 16(3), 63-74.

Al-Shaer, H., & Taman, H. (2016). Corporate governance and firm performance in the Egyptian insurance industry. International Journal of Business and Management, 11(2), 199-215.

Ameer, R., Othman, R., & Abdul-Rahman, A. R. (2018). Corporate governance and firm performance in emerging markets: Evidence from Malaysia. Pacific-Basin Finance Journal, 51, 198-217.

Anwar, M. F., Hussain, S. T., & Khan, M. A. (2020). Corporate governance and financial performance: evidence from insurance companies of Pakistan. Future Business Journal, 6(1), 1-14.

Bhagat, S., & Black, B. (2002). The non-correlation between board independence and long-term firm performance. Journal of Corporation Law, 27(2), 231-273.

Becht, M., Bolton, P., & Roell, A. (2002). Corporate governance and control. Handbook of the economics of finance, 1, 1-109.

Berman, S. L., Wicks, A. C., Kotha, S., & Jones, T. M. (1999). Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Academy of Management Journal, 42(5), 488-506.

Black, B. (2001). The rise of institutional investors as universal owners. Oxford Review of Economic Policy, 17(2), 183-199.

Bohren, O., & Staubo, S. (2014). Does mandatory gender balance work? Changing organizational form to avoid board upheaval. Journal of Corporate Finance, 28, 152-168.

Boubakri, N., (2011). Corporate Governance and Issues from the Insurance Industry. © The Journal of Risk and Insurance, 2011, Vol. 78, No. 3, 501-518. DOI: 10.1111/j.1539-6975.2011.01429. x.

Brav, A., Jiang, W., Partnoy, F., & Thomas, R. (2008). Hedge fund activism, corporate governance, and firm performance. Journal of Finance, 63(4), 1729-1775.

Cadbury, A. (1992). Report of the committee on the financial aspects of corporate governance. Gee & Co.

Choi, H., Lee, J., & Park, K. (2012). Corporate governance and firm value: Evidence from the Korean insurance industry. Journal of Risk and Insurance, 79(3), 595-623.

Calder, A., (2008). Corporate governance: A practical guide to the legal frameworks and international codes of practice. London; Philadelphia: Kogan Page.

Carroll, A. B., & Shabana, K. M. (2010). The business case for corporate social responsibility: A review of concepts, research, and practice. International

Clarke, R., & Dean, G. (2007). The association between corporate governance and performance in the UK insurance industry. The Journal of Risk Finance, 8(3), 246-259.

Clarke, T. (2004). Theories of corporate governance: The philosophical foundations of corporate governance. Routledge.

Carroll, A. B. (1979). A three-dimensional conceptual model of corporate performance. Academy of Management Review, 4(4), 497-505.

Coffee, J. C. (2012). The future as history: the prospects for global convergence in corporate governance and its implications. Northwestern Journal of International Law & Business, 32(3), 499-543.

Cornforth, C., & Brown, W. A. (2003). The governance of cooperatives and mutual associations: A paradox perspective. Annals of Public and Cooperative Economics, 74(4), 519-550.

Cummins, J. D., Phillips, R. D., & Weiss, M. A. (2006). The incentive effects of monopoly power on corporate performance. Journal of Banking & Finance, 30(5), 1353-1376.

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm. Englewood Cliffs, NJ: Prentice-Hall.

Daily, C. M., Dalton, D. R., & Cannella Jr, A. A. (2003). Corporate governance: Decades of dialogue and data. Academy of Management Review, 28(3), 371-382.

Dandago, D.K.I., (2013). Impact of Corporate Governance Mechanisms on the Financial Performance of Listed Insurance Firms in Nigeria. International conference on Luca Pacioli in accounting history and 3rd Balkans and middle east countries, June (2013). Retrieved from http://dergipark.gov.tr/download/article-file/319860

Davis, J. H., Schoorman, F. D., & Donaldson, L. (1997). Toward a stewardship theory of management. Academy of Management Review, 22(1)

Davis, E. P., & van der Werf, M. (2014). Corporate governance and performance in the wake of the financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 27, 332-350.

Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No. 111-203, 124 Stat. 1376 (2010).

Donaldson, T., & Davis, J. H. (1991). Stewardship theory or agency theory: CEO governance and shareholder returns. Australian Journal of Management, 16(1), 49-64.

Donaldson, T., & Preston, L. E. (1995). The stakeholder theory of the corporation: Concepts, evidence, and implications. Academy of Management Review, 20(1), 65-91

Economic Research Forum. (2018). Egypt: Insurance sector dynamics. Retrieved from https://erf.org.eg/wp-content/uploads/2018/12/INSURANCE-SECTOR-DYNAMICS-Egypt.pdf

El-Gammal, W. (2019). The insurance sector as a contributor to economic development: A case study of Egypt. International Journal of Economics, Commerce and Management, 7(1), 1-11.

El-Habashy, M., & Abdel-Salam, O. (2016). Corporate governance and financial performance of insurance companies in Egypt. Journal of Insurance and Financial Management

El-Masry, A. A. (2013). Corporate governance and performance of Egyptian insurance companies. Journal of Economic and Administrative Sciences, 29(1), 1-27.

El-Masry, A., & Abdelfattah, T. (2017). Corporate governance and financial performance of non-takaful insurance companies in Egypt. Managerial Finance, 43(12), 1454-1470.

El-Masry, A. A., & Abdel-Kader, M. G. (2014). Corporate governance and the financial performance of Egyptian banks.Journal of Applied Accounting Research, 15(1), 82-97.

El-Said, H. and Salem, M. (2020). The role of board diversity in corporate governance: Evidence from the Egyptian insurance sector. Journal of Risk and Financial Management, 13(11), 272.

Elsas, R., & Florysiak, D. (2016). Corporate governance and debt maturity: International evidence. Journal of Corporate Finance, 38, 157-173.

Elsayed, M. A., & Ismail, W. E. (2018). Corporate governance, risk, and profitability: Evidence from the Egyptian insurance industry. Journal of Financial Reporting and Accounting, 16(2), 177-196.

Eisenhardt, K. M. (1989). Agency theory: An assessment and review. Academy of management review, 14(1), 57-74.

Erkens, D. H., Hung, M., & Matos, P. (2012). Corporate governance in the 2007-2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 18(2), 389-411.

Fahmy, H. A., & Hegazy, M. A. (2020). The impact of corporate governance on financial performance: an empirical analysis of the insurance sector in Egypt. Journal of Financial Reporting and Accounting, 18(4), 574-590.

Fakry, K. and El-Khazindar, K. (2021). The impact of ownership structure on corporate governance: Evidence from the Egyptian insurance sector. Research in International Business and Finance, 56, 101330.

Faleye, O., Hoitash, R., & Hoitash, U. (2011). The costs and benefits of appointing friends and family to boards of directors. Journal of Business Ethics, 103(3), 413-429.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. The Journal of Law and Economics, 26(2), 301-325.

Galbraith, C. S. (2006). Sarbanes-Oxley Act: unintended consequences of the “corporate transparency” law. Journal of Business Ethics, 67(2), 143-152.

Gelter, M. (2011). The failure of corporate law: fundamental flaws and progressive possibilities. Cambridge University Press.

Ghoshal, S., & Moran, P. (1996). Bad for practice: A critique of the transaction cost theory. Academy of Management Review, 21(1), 13-47.

Gillan, S. L., & Martin, J. D. (2016). Corporate governance post-Enron: Comparative and international perspectives. John Wiley & Sons.

Global Reporting Initiative. (2013). Sustainability reporting guidelines. Retrieved from https://www.globalreporting.org/Pages/default.aspx

Gulati, R. (1995). Social structure and alliance formation patterns: A longitudinal analysis. Administrative Science Quarterly, 40(4), 619-652.

Hardy, C. (1996). Power and politics in organizations. Sage.

Hillman, A. J., & Keim, G. D. (2001). Shareholder value, stakeholder management, and social issues: What's the bottom line? Strategic Management Journal, 22(2), 125-139.

Huynh, L. T., Tran, V. T., & Le, H. P. (2021). The impact of corporate governance on firm performance: Evidence from insurance companies in emerging markets. Emerging Markets Review, 46, 101059.

Ibrahim, N. A., & Angelidis, J. P. (2015). Corporate governance and corporate performance: A study of Greek firms. Journal of Applied Accounting Research, 16(3), 316-335.

Insurance Federation of Egypt (IFE). (2020). Annual report 2019. Retrieved from http://www.ife-egypt.org/wp-content/uploads/2020/11/IFE-Annual-Report-2019.pdf

Ismail, S., & El-Gammal, W. (2018). Corporate governance, risk management and financial performance: evidence from Egyptian insurance companies. Journal of Risk and Financial Management, 11(4), 79.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of financial economics, 3(4), 305-360.

Jensen, M. C., & Murphy, K. J. (1990). Performance pays and top-management incentives. Journal of political economy, 98(2), 225-264.

Kahya, E., & Ozkan, N. (2019). Does board independence matter for firm value? Evidence from Turkish listed firms. Corporate Governance: The International Journal of Business in Society, 19(6), 1206-1226.

Kordonska, S., & Kostadinova, R. (2018). Transparency and corporate governance. Economic Alternatives, 1, 102-113.

Kumar, R., & Singh, J. P. (2018). An analysis of the Cadbury report: Its implications on corporate governance practices worldwide. Global Business Review, 19(2), 301-314

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., & Vishny, R. W. (2000). Investor protection and corporate governance. The Journal of Financial Economics, 58(1-2), 3-27.

Lawrence, P. R., & Lorsch, J. W. (1967). Organization and environment: Managing differentiation and integration. Harvard University Press.

Lorsch, J. W., & MacIver, E. (1989). Pawns or potentates: The reality of America's corporate boards. Harvard Business Review, 67(2), 104-113.

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of Management Review, 26(1), 117-127.

Millstein, I. M. (1998). Corporate governance: Improving competitiveness and access to capital in global markets. Business Economics, 33(4), 7-10.

Mizruchi, M. S., & Fein, L. C. (1999). The social construction of organizational knowledge: A study of the uses of coercive, mimetic, and normative isomorphism. Administrative Science Quarterly, 44(4), 653-683.

Monks, R. A. G., & Minow, N. (2011). Corporate governance. John Wiley & Sons.

Mudawi, H. M. A., & Abdelgadir, M. A. (2016). Corporate governance and financial performance in Sudanese insurance companies. Journal of Accounting and Management Information Systems, 15(2), 321-338.

Najjar, N.J., (2012). The Impact of Corporate Governance on The Insurance Firm’s Performance in Bahrain. International Journal of Learning & Development. Vol.2, no. 2. Retrieved from https://doi.org/10.5296/ijld.v2i2.1412

Narayanan, R., & Rajarao, V. (2021). Corporate governance in insurance companies: Issues and challenges. Journal of Insurance Regulation, 40(4), 78-96.

Nguyen, T. M. H., & Nguyen, P. T. H. (2020). Corporate governance and firm performance: evidence from Vietnam. Journal of Asian Business and Economic Studies, 27(1), 79-90.

Oduwole, J. (2015). Corporate governance: Accountability, transparency, and ethical conduct. International Journal of Economics, Commerce and Management, 3(7), 1-18.

OECD. (1999). Principles of Corporate Governance. OECD Publishing.

OECD. (2015). OECD Principles of Corporate Governance. Retrieved from https://www.oecd.org/daf/ca/corporategovernanceprinciples/Corporate-Governance-Principles-ENG.pdf

Palaniappan, G., (2017). Determinants of Corporate Financial Performance Relating to Board Characteristics of Corporate Governance in India Manufacturing Industry: An empirical study, European Journal of Management and Business Economics, Vol. 26 Issue: 1, pp.67-85, Retrieved from: https://doi.org/10.1108/EJMBE-07-2017-005.

Pfeffer, J., & Salancik, G. R. (1978). The external control of organizations: A resource dependence perspective. Harper & Row.

PwC. (2014). Corporate governance in insurance: Building public trust and confidence. Retrieved from https://www.pwc.com/gx/en/insurance/publications/assets/pwc-corporate-governance-in-insurance-building-public-trust-and-confidence.pdf

Saha, S. (2017). The emergence of corporate governance: A historical perspective. Corporate Governance, 17(4), 578-588.

Sarbanes-Oxley Act of 2002, Pub. L. No. 107-204, 116 Stat. 745 (2002).

Sherif, M., Elsayed, M., (2013). The impact of corporate characteristics on capital structure: evidence from the Egyptian insurance companies 27.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. Journal of Finance, 52(2), 737-783.

Solomon, J. (2010). Corporate governance and accountability. John Wiley & Sons Ltd.

Sonmez, D.M., Yildırım, S., (2015). A Theoretical Aspect on Corporate Governance and Its Fundamental Problems: Is It a Cure or Another Problem in the Financial Markets? Journal of Business Law and Ethics https://doi.org/10.15640/jble.v3n1a2

Sood, M., )2015(. Corporate governance and the performance of banking and insurance sector in India: an empirical analysis. International Journal of Research in Commerce & Management. Vol. 6, Iss. 2. Retrieved from https://eds.b.ebscohost.com/eds/detail/detail?vid=3&sid=4c7216b4-2e38-44d8-8489-b0ac6275c26d%40pdc-v-sessmgr02&bdata=JnNpdGU9ZWRzLWxpdmU%3d#AN=119728747&db=bsu

Stowell, D. B. (2012). Dodd-Frank Wall Street Reform and Consumer Protection Act: a summary. Journal of Investment Compliance, 13(1), 5-18

Tricker, B. (2015). Corporate governance: Principles, policies, and practices. Oxford University Press.

Tricker, B. (2020). Corporate governance: Principles, policies, and practices. Oxford University Press.

Wallison, P. J. (2006). Sarbanes-Oxley: costs, benefits, and business impacts. Journal of Applied Corporate Finance, 18(4), 72-81.

Ward, D., (2003). Can Independent Distribution Function as a Mode of Corporate Governance? An Examination of the UK Life Insurance Market. Journal of Management and governance. Vol. 7, pp. 361-384.

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(2), 185-211.

Yermack, D. (2010). Corporate governance and shareholder activism. Review of Finance, 14(1), 1-23.

Zahra, S. A., & Pearce, J. A. (1989). Boards of directors and corporate financial performance: A review and integrative model. Journal of Management, 15(2), 291-334.

Author: Rania Abouelezz, student LIGS University

Approved by: Dr. Minh Nguyen, lecturer LIGS University